Rekindling the Spark

Rekindling the Spark

Go by the headlines, and the future seems bleak for the internal combustion engine, the trusty workhorse of modern mobility. This past year has seen announcements from several major countries—France, Germany, Great Britain, and India—stating their intention to ban fossil-fuel powered automobiles entirely.

To a certain extent, those announcements can be dismissed as aspirational, as the goals are set for 2040, far beyond the life expectancy of cars on the road today. Still, Norway, an oil-exporting nation that is a leader in electric vehicles, has a deadline of 2025 for the end of emissions-producing vehicles.

In September, China—where about 40 percent of all cars in the world are sold—weighed in. In a step forward from previous efforts, which focused on pushing auto firms to produce more electric vehicles while putting strict limits on car registration in crowded and heavily polluted Beijing and Shanghai, China’s vice minister of industry and information technology said the government is working with other regulators on a timetable to end production and sales of combustion-powered cars.

Even in the United States, which has shown no appetite for sweeping action at the federal level, eight states have set goals for electric-powered vehicles and aggressive emissions and mileage standards have promoted the development of cleaner and more efficient cars. In many cases that means cars with hybrid gas-electric power trains rather than all-electric battery-powered vehicles. But Tesla Motors, the manufacturer of electric cars, has a market capitalization of $61 billion, more than such established automakers as Ford, Honda, and General Motors.

While governments and financial markets may be in love with battery-powered electric vehicles, don’t count out the internal combustion engine just yet. Continuing refinements are making the ICE smaller, stronger, and less polluting. The technology is not yet ready to lose its place in powering cars and trucks.

“From a marketing standpoint, electrification and battery-powered engines are the absolute darling,” said Brett Smith, assistant director of manufacturing, engineering, and technology at the industry-backed Center for Automotive Research in Ann Arbor, Mich. “The reality is that it is a long-term trend that may take decades to get here. And because of the pressures of regulation, there has been an incredible amount of refinement to gas engines.”

For many nonspecialists, the case for electric vehicles is straightforward: It’s all about carbon dioxide and other emissions. But the advantage EVs hold at the tailpipe is not as strong as laypeople believe. For one, it does not take into account emissions from power plants that provide the electricity for EVs. In some regions that depends on coal power for electric generation, a conventional car that gets as little as 40 mpg will produce fewer emissions than an EV. Also, the environmental damage along the supply chain for lithium-ion batteries can be significant. A 2016 study by Arthur D. Little, the international consulting firm, comparing battery electric vehicles against internal combustion engine vehicles stated, “The ultimate environmental and economic reality of electric vehicles is far more complicated than their promise.”

The study showed BEVs enjoy economic advantages. The electricity cost associated with operating BEVs over a distance of one mile is significantly lower than the cost of gasoline over the same distance for a conventional car. The cost to maintain a BEV also is less, and battery technology has evolved to where the price per kilowatt hour of lithium-ion battery packs has dropped from $1,126 in 2010 to only $300 in 2015, according to the report.

But other economic factors intervene. Without exception, BEVs in 2015 were significantly more expensive to manufacture than internal combustion engine vehicles, mostly because of battery manufacturing, and were much more expensive at the dealer.

The report shows that most of the environmental impacts generated by ICEVs are localized to the combustion of gasoline in the engine, but the BEV manufacturing process “generates a much more widely dispersed and damaging set of environmental impacts.” Those effects include the use of heavy metals in the manufacture of lithium-ion battery packs combined with pollution generated by the U.S. power grid when charging. Battery production relies on metals such as cobalt and materials like graphite, sourced from “poorly regulated and heavily polluting mines” in China and Africa.

“Given the divergence in where environmental impacts are allocated, it is safe to say that a consumer who chooses to drive a BEV over an ICEV shifts the environmental impact of ownership,” according to the report. In other words, BEVs reduce local contributions to greenhouse gas emissions but they produce a different set of environmental challenges across the globe, “the consequences of which are largely borne by rural and often disadvantaged communities as well.”

Even with the drop in the cost of battery packs, the total cost of owning an EV in 2025 will still be between $6,000 and $11,000 higher than owning a conventional car, the A.D. Little report concludes.

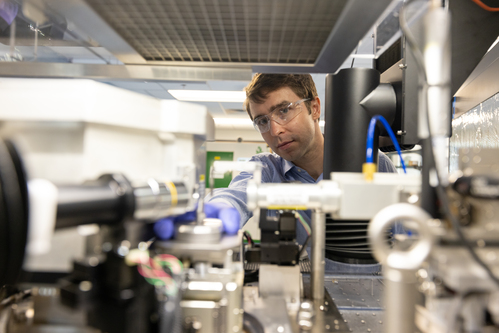

According to John Dec, a researcher at the Sandia National Laboratories Combustion Research Facility in Livermore, Calif., the performance of internal combustion engines will improve over the coming decade. Advances in friction, motor oil, and fuel will mean battery-electric powertrains will have to improve more than anticipated to catch up with the performance of internal combustion engines.

“EVs are coming and they will grow,” Dec said. “But it’s way, way premature to say the internal combustion engine is dead.”

Combustion Control

What sort of improvements are in store for the internal combustion engine? One recent example of innovation is direct fuel injection.

Direct injection sends highly pressurized gasoline into the combustion chamber of each engine cylinder, promising greater fuel economy and lower emissions. Many manufacturers worked on the system over the second half of the 20th century, but in 2004 Isuzu became the first company to offer the system in a mainstream vehicle in the U.S. market. By 2007, Detroit entered the competition as Ford introduced its EcoBoost line of engines and General Motors its V6 LLT SIDI for Cadillac.

“There’s a lot that’s been happening since ’07,” Smith said. “The industry is really good at refining something.”

By some estimates, about half of models sold in the U.S. this year feature direct injection.

“The technology just continues to improve along with our ability to control and manipulate the combustion process,” agreed Robert M. Wagner, director at the National Transportation Research Center at Oak Ridge National Laboratory in Tennessee.

The next step in control of the combustion process may be Mazda’s SkyActiv-X engine, a homogenous charge compression ignition engine that researchers and manufacturers have been working to fine-tune for years. An HCCI engine uses gasoline in what is basically a diesel engine supplemented by spark plugs.

Spark-ignition engines are ubiquitous. A fuel injector sprays a mist of gasoline into the cylinder as the piston compresses air to one-tenth of the original volume. The spark plug ignites the fuel mix, driving down the piston to produce power.

Diesel engines have a compression ratio of about 20:1, providing more stored energy, and diesel fuel is ignited at higher temperatures provided by that higher compression. An HCCI engine tries to combine the high compression of a diesel engine with faster-burning gasoline to provide more power.

“The challenge with HCCI has always been to control when ignition actually happens,” said Shawn Midlam-Mohler, an associate professor of practice at Ohio State University’s Mechanical and Aerospace Engineering Department in Columbus.

Mazda says it has solved that problem. The company’s SkyActiv-X engine will use a spark plug in each cylinder to jump-start the process and control combustion, mostly during startup when the engine is cold. It is not unlike conventional glow plugs used in starting cold diesel engines. Mazda calls it spark-controlled compression ignition.

The company claims its engine is 10 to 20 percent more efficient than its current models.

“We think it is an imperative and fundamental job for us to pursue the ideal internal combustion engine,” Mazda R&D head Kiyoshi Fujiwara said in announcing the new engine, which will be installed in 2019 vehicles. “Electrification is necessary, but the internal combustion engine should come first.”

Nissan is introducing another technology that has been percolating on the research burners, the variable compression engine with a turbocharger.

Varying the engine’s compression ratio is a long-time goal of auto makers and Nissan’s engine is the result of some two decades of research and more than 300 patents. Nissan says the VCT can be dynamically varied from 8:1 for high performance up to 14:1 for efficiency.

The VC-T 2.0 liter, four-cylinder engine will initially be offered on the 2018 Infiniti QX 50 crossover, but is expected to be added throughout its lineup. The engine promises a 27 percent gain in fuel economy over the company’s 3.5 liter V-6 engine. According to Nissan, “The sophisticated engine control logic automatically applies the optimum ratio, depending on what the driving situation demands.”

The key to the engine is a multi-link piston rod. Compound connecting rods are fitted into the crankcase and offer computer control over the ratio of each piston. Manufacturers have experimented with compound rods but durability issues have until now prevented their use.

The company claims it can move between the levels of compression ratios in 1.5 seconds.

The engine also runs on the Atkinson cycle at times, which is a great companion for a hybrid system.

“It’s not hard to implement,” said Paul Miles, manager of the engine combustion department at Sandia’s Combustion Research Center.

The Atkinson cycle has been around since the 19th Century, but its use in auto engines has been limited. While fuel efficient, it doesn’t provide enough power for the acceleration needed for passing.

That problem can be solved by including an Atkinson engine in a hybrid-electric drivetrain. While the Atkinson provides the power for standard cruising speed, the electric motor can pick up the slack when more power is needed.

Toyota took a different tack when it introduced a new engine in its 2016 Tacoma pickup truck. Rather than adding an electric boost when more power is required, Toyota changes the cycle of the engine itself as needed. The engine runs on a conventional Otto cycle engine to provide the muscle for towing, but when full power isn’t required, such as when the truck maintains constant speed, the valve timing changes to the Atkinson cycle to save fuel. The switch is seamless and undetectable by the driver.

The engine also includes two methods of fuel delivery into the engine, direct injection and port injection, and uses one or both as needed for each level of power requirement.

The engine is a hybrid, but an Otto-Atkinson-cycle hybrid, rather than a gas-electric one.

“The Toyota engine is unique,” Miles said. “It’s designed for a hybrid, and is 15 percent better than a typical engine today.”

“You can do a lot of these things now because of greater computer processing power,” Smith noted, adding that the ability to better machine parts and control engine combustion has been key to ICE improvements. “You can understand what is happening in the cylinder and adjust on the fly. It gives you a strong understanding of what you can and cannot do.”

Boosting Power

Automakers have introduced other tricks in recent years. Transmissions now feature eight to 10 speeds that keep engine operations at high efficiency, and electronic starters can seamlessly shut the engine off for brief periods when stopped instead of idling, starting the engine up again when the driver removes the brakes.

One popular advance involves turbochargers and superchargers that can boost four-cylinder engines to provide power like a larger engine while delivering the fuel economy of a smaller one. But researchers believe this ability to compensate for downsized engines through turbocharging may have hit its limits.

“The trend to downsize may continue but I don’t think you can get too much smaller,” Miles said.

Some groups are looking to improve the performance of small engines by changing the electrical system of the entire car.

Traditionally, most cars have operated on a 12V electrical system that handles cooling, lighting, and information and entertainment systems. On some high-end cars and SUVs, however, this 12V system is supplemented by a more robust 48V one capable of powering not just electronics and AC, but also start-stop motors and turbochargers. It allows smaller engines to be used for better fuel economy wihtout hampering performance.

For instance, four-cylinder engines boosted by a turbocharger now give the performance of a standard V-6 engine. Still, there is some lag where the turbo speeds up RPM when a driver presses the accelerator to pass or needs a burst of speed. An electric turbocharger running off a 48V electric system will reduce that lag.

“The next logical step is 48-volt technology,” Smith said.

Combining a four-cylinder turbocharged engine with a 48V system effectively produces a mild hybrid powertrain that increases fuel efficiency by 15 to 20 percent—at about one-third the cost of a traditional hybrid.

“You’re going to see it in luxury cars,” Smith added. “Volvo is clearly at that point.” Volvo, owned by China’s Geely Holding Group, announced it is moving to electric and hybrid vehicles and will no longer produce gasoline-only cars after 2019.

“In the U.S.,” Smith continued, “it will be interesting. SUVs would be interesting. In smaller cars, it probably does not make a lot of sense, except for maybe emission standards coming in 2023. The consumer just won’t pay.”

That price differential—and the American consumer’s unwillingness to pay it—may keep internal combustion engines on the road in the U.S. long after they have disappeared from showrooms around the world. Aside from niche applications and luxury vehicles such as Tesla Motors offerings, battery electric vehicles just won’t be able to compete with the internal combustion engine, alone or in gas-electric powertrains.

“I think the vast majority of the fleet will be using the internal combustion engine with [new] electric technology,” Dec predicted. “It should co-exist for at least three more decades.” ME

Read the latest issue of the Mechanical Engineering Magazine.

I think the vast majority of the fleet will be using the internal combustion engine. John Dec, Sandia National Laboratory